Insights

After-tax returns – The true indicator of investment success

By Aleks Petkovic

An often-underappreciated element of any investment strategy is the tax erosion, or the proportion of the overall return that is lost to tax and therefore reduced the net return that is actually received by the investor).

Too often, investors may make some general observations on the prospective tax efficiency of any investment and use this as the main conclusion of their diligence.

There is very little substantiation or quantifying the actual tax costs, benchmarking these against peer investment options, and ultimately identifying ways to proactively manage this erosion.

Likewise, the old adage of ‘you can’t manage what you don’t measure’ applies, and investors should ensure that tax planning is a critical part of an overall investment strategy.

1. Balance sheet structuring

Being deliberate in how an individual investment best aligns with particular entity types (most commonly Trust, Company or Super Fund) of a Family Group is often the easiest way to mitigate against excessive tax erosion.

Each entity structure will have a different tax treatment, both of income as well as discounted/non-discounted capital gains. Understanding the specific return profile and how this aligns with the entity’s tax profile will often have a material impact on an investors after-tax return.

It may mean that an individual entity looks somewhat ‘lop sided’ and different to other entities in the Family Group, but the benefit may well be worthwhile.

Estimates suggest that this can improve the consolidated balance sheet return by anywhere up to 1% p.a., especially if there is a close collaboration between the investment adviser and tax adviser for the family.

2. Hedging strategies

Many successful investors have one (or many) investments that fit the following description on their balance sheet:

- A super high-quality investment which has been held for a very long period, or

- An investment which has performed spectacularly well over the short/medium term.

The end outcome is that this investment is now so large and disproportionate to the overall strategy (and has a very large unrealised capital gain to match!).

This is the classic investor’s dilemma, where the desire is now to derisk or rebalance the portfolio, perhaps to bank some of the gains, distribute funds to family or fund new investment ideas. However, the act of selling this investment, and realising the tax, creates such a cost that an investor is paralysed by the decision and ultimately, the decision is deferred indefinitely.

There are numerous hedging strategies which can mitigate some of this cost and achieve the above objectives of creating liquidity and rebalancing the portfolio, but defer the tax impost which would be triggered with an outright sale of the asset.

3. Tax deferred income

The logic and benefit behind tax deferred income is relatively well established, in particular for property-based investments.

All other things being equal, a higher proportion of tax deferred income is a positive:

- Investors will receive the yield of an investment in their cash account, but will only pay tax on the component of the yield, which is not tax deferred

- The proportion of income that may be tax deferred will range from 0% in some cases right to 100% in other scenarios, and will typically depend on the depreciation profile of an asset

- The non-deferred component will be taxed at the investors marginal tax rate, as part of the year in which it has been received

- However, the tax deferred component will only be taxed upon the sale of the asset, which may well be five to seven years (or longer) after the income has been received

- Likewise, if the property is subject to capital gains tax discounts, the effective tax rate will be much lower (i.e. discounted CGT rate is much lower than the marginal tax rate)

This is almost an ideal scenario for an investor, receive the yield in the current period, but defer the tax treatment of it. Even when the tax is realised, the tax rate is lower!

Based on actual investments which we have seen and implemented, the net after-tax benefit, of this principle can range anywhere from 0.5% p.a. to 1.5% p.a.

4. Turnover of listed equities

All other things being equal, frequent buying and selling of stocks in a portfolio is a very costly exercise – not only does it incur trading fees, but it also creates a tax consequence with each action.

One of the reasons why investors have flocked to index funds in recent years is that an ‘average’ broad market index tracker (fund or ETF) has turnover of 2-5% p.a.

On the other hand, even a low turnover active fund will typically have turnover of c. 25% p.a. (and in some cases much higher).

By our analysis, and a set of balanced assumptions, the tax cost of the latter strategy is anywhere from 1-2% per annum above its passive index.

The above is a small subset of all the potential tax principles, which may be a more nuanced/applicable only to specific investment types or points in time, however, the conclusion and benefit is clear:

- Investors should incorporate best practice tax principles as part of the initial formal due diligence, as well as ongoing management, of their investment holdings and overarching strategy,

- The benefit of this application of tax is that an investor can increase their ‘net’ returns without taking an increased level of risk, concentration or illiquidity, or increasing the level of fees.

- This is the truest form of a ‘risk adjusted return’ where the investment composition does not change, but it generates a higher level of net return – the only definition of excess return that matters!

- To best achieve this outcome, an investment adviser should have a working knowledge of tax principles and a close relationship with the family’s tax adviser

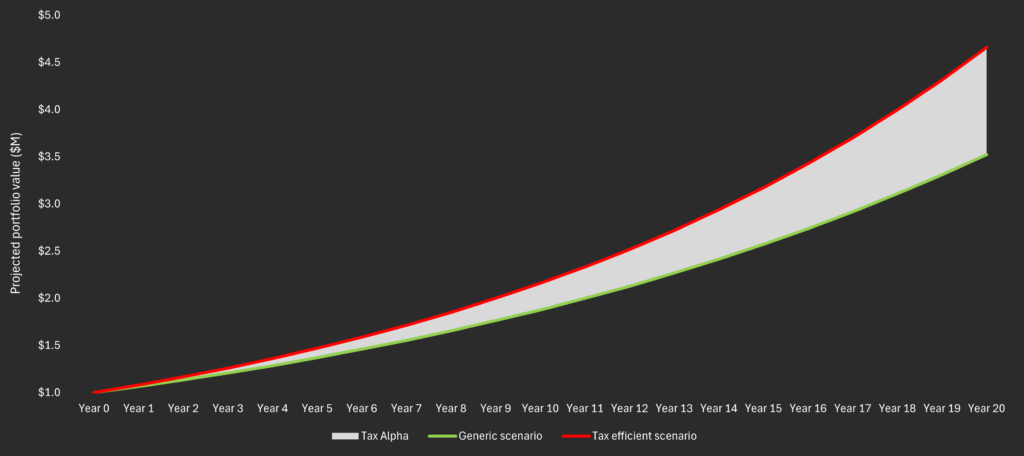

The below chart summarises the impact of actively managed tax principles over the long term and highlights the real-world financial impacts of incorporating diligent tax planning as part of investment management.

In this example, tax alpha generated an additional 33% return premium over 20 years!